MORGAN COUNTY — Local governments across the state are scrambling to unravel the impacts of the 345-page contentious property tax reform bill, and Morgan County officials are no exception.

Senate Bill 1 — now officially called Senate Enrolled Act 1 (SEA1) — was signed into law by Gov. Mike Braun on April 15. The bill saw drastic changes throughout the Indiana legislative session, but in its final form, it will provide property tax cuts for some Hoosier families and large tax cuts for businesses.

The bill drew criticism from some local governments, who will miss out on hundreds of millions of dollars of revenue in the next few years. While their revenues will still increase, it will be much less than they expected and would have received under previous law. However, cities and towns could make up some of that deficit through local income taxes thanks to upcoming changes in the local income tax structure.

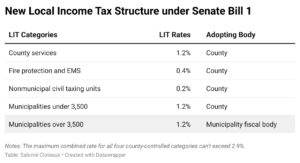

Currently, counties in Indiana collect local income taxes and distribute them to cities, towns and other entities. The maximum local income tax rate they can collect is 2.5 percent (2.75 percent in Marion County) plus 1.25 percent for property tax credits, for a total of 3.75 percent.

SEA1 will increase the county expenditure rate from 2.5 percent to 2.9 percent but will eliminate the additional 1.25 percent rate, therefore decreasing the total amount of local income taxes. (To fund property tax credits instead, counties will be able to impose a 0.3 percent local income tax rate as part of their total county expenditure rate).

SEA1 will also allow cities or towns with a population of 3,500 or more to impose their own additional local income tax rate up to 1.2 percent starting in 2028. For cities or towns with less than 3,500 people, counties may adopt a local income tax rate of up to 1.2 percent, as part of the total county expenditure rate.

Proponents of the bill argued it will give local governments more flexibility and diversity in their revenue structure, but some critics worried it will just shift the tax burden from property taxes to local income taxes.

The law goes into effect July 1, 2025, but most of the changes to the local income tax structure won’t take place until July 1, 2027.

A question local governments are facing now is whether to increase local income taxes to offset the property tax revenue deficit — and if so, by how much.

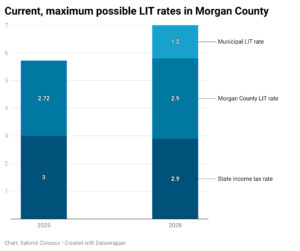

While local income taxes have increased in recent years, the state income tax has been progressively declining at a faster pace, so the combined rate has decreased. Indiana currently has a state income tax of about 3 percent, which will progressively decrease to 2.9 percent in 2027.

However, if counties raise their income taxes to the maximum rate allowed under SEA1, the total income tax rate could rise, and with the maximum 1.2 percent municipal LIT rate on top, it could reach 7 percent.

Morgan County

Morgan County currently has one of the lowest property tax rates in Indiana but one of the highest local income tax rates in Indiana, with 2.72 percent.

One-third of Morgan County’s general fund budget comes from property taxes, and two-thirds comes from income taxes, county administrator Josh Messmer said, and the county relies heavily on local income taxes to offset the low property taxes.

About 1 percent out of the 2.72 percent local income tax rate goes toward providing property tax relief, reducing the tax burden on property owners. SEA1 will cap that at 0.3 percent — less than a third of the current rate — which will disproportionately put the tax burden on property owners as opposed to everyone, Messmer said.

“If the bill continues forward without changes, Morgan County taxpayers will see a drastic increase in their property taxes, almost dollar for dollar what’s lost out of income tax,” he said.

Reedy Financial Group, the county’s financial advisor, expects property tax rates will increase under SEA1, but the net assessed value of properties and the county’s net property tax levy will decrease.

Messmer said the way the law is structured will put many more taxpayers at property tax caps or above them, which will represent a loss in revenue for the county.

According to a budget outlook from Reedy Financial Group, Morgan County’s property tax levy will be $1.37 million less in 2026 than it would have been without SEA1. In total, the Indiana Legislative Services Agency predicted the county will miss out on almost $3.8 million in revenue in 2026.

Messmer said the impact of SEA1 will be mild next year but may be a much bigger deal later, especially in two budget cycles when the new LIT rates come into effect.

“We’re being told from the state level, ‘We’ll fix this bill; we know there’s some holes,’” he said.

If the law doesn’t change, however, local governments will soon have to grapple with the tough question of whether to raise new taxes or cut services — or both.

“It’s a very hollow promise that we cut taxes — nothing has been cut,” Messmer said. “No one I’ve talked to in local government has any confidence this will be a net savings. If we have services we have to provide, the money will have to come from somewhere or cut them.”

Messmer said he understands the state lawmakers’ intention to clarify for taxpayers who’s putting the burden of taxes on them and why, but he thinks it was done too quickly and haphazardly.

“All in all, our impression is it’s just not a good bill. If it’s not changed, it’s going to hurt Morgan County taxpayers a great deal in the coming years,” Messmer said. “There is no way, by the time the bill fully takes effect — if it’s unchanged — we can continue to provide the level of services we do at the tax rate we do,” Messmer said.

Martinsville and Mooresville

As the two cities or towns in Morgan County with a population of 3,500 or more, Martinsville and Mooresville are the only ones that could impose their own municipal income tax on top of the county tax.

Phil R. Deckard II, president of Martinsville City Council, said next year, Martinsville’s budget will look similar to the current budget, but after that, the city may have to make cuts.

“They give us our chunk of a pie, and then we have to deal with what we receive,” Deckard said.

He said throughout the state, there is a possibility cities and towns will have to implement a local income tax, but he hopes the law will be amended and provide some relief.

“But at this time, we’ve got to plan like that’s not coming,” Deckard said.

Ben Merida, Martinsville’s clerk treasurer, said while the city’s budget will remain more or less stagnant the next two years, from 2028 to 2030, Martinsville could look at losing millions of dollars in property tax revenue. He said there have been discussions about imposing a municipal local income tax to offset that shortfall, but it’s too early to tell.

“Preliminary numbers are all we have,” Merida said.

He is waiting for further guidance from the Indiana Department of Local Government Finance, which certifies budgets and sets tax levies and tax rates.

It’s difficult to calculate the long term impacts of Senate Bill 1, but according to current forecasts, it appears property tax bills could go up, Merida said. Still, he believes taxpayers will probably end up getting some tax relief, and the law will force local governments to be more transparent about taxes.

“The most critical thing is making sure we educate the citizens so they know where their tax dollars are truly going,” Merida said.

Tom Warthen, president of Mooresville Town Council, said the council is working with a financial advisory firm, but it is too early to tell what the impact of the bill is going to be. The council is looking at all the options to make sure they don’t cut the services they provide to citizens.

“We’re like every other community in Indiana right now,” Warthen said. “We are assessing all of the legislation. We’re trying to figure out what the impacts will be.”